Philippines BPI SWIFT/BIC Codes

The SWIFT network for payments became extremely popular. Even after its boom in the present-day global market and numerous alternative services pioneered, this financial system stays at the top. The closest competitors that are dreaming about the winner’s podium like SWIFT has are SEPA, SpenDesk, Vena, Anaplan, and Coupa. But the rating of these networks is far lower than the top-performing financial service vendor.

It is used for safe international payments. People worldwide prefer this system for its transparency, global outreach, and security aspects. The network is absolutely digital-friendly which makes it optimal for money transfers throughout the world.

The Philippines is among the countries that use SWIFT. To coordinate payments overseas, the sender should know the special-purpose code that can contain from 8 up to 11 characters. Everything depends on the location of the receiver and the bank that serves his/her funds. Sending money to the Philippines also requires a BPI/BIC identification code to be sure that the transaction is successful and that all the funds hit the right person.

How Do SWIFT Codes Look Like?

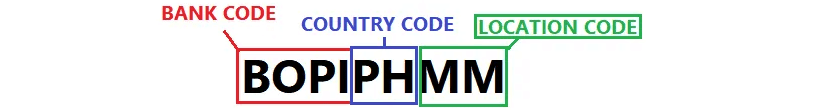

This is the most common misconception that bank identifier coding is the same for the whole territory of the country. The key aspects that format such codes are:

- The bank code (presented in the letter format only);

- The country code (introduced in the letter format only);

- The location code (could include both a letter and a digit);

- The branch code (could contain both a letter and a digit).

If you know all the required data entries, getting the SWIFT code ready for international money transfers is possible. Note that this network with BPI/BIC is just the introductory party between the sender and the recipient. That is why the correctness of the identifier codes is the responsibility of people who take part in the process of sending money and receiving these funds.

How to Know the Correct Philippine BPI SWIFT Code?

In most cases, recipients are more interested in the correctness of the BPI SWIFT code used for the transactions. This is the guarantee that the expected amount is not going to be lost. But people looking forward to safely sending funds overseas (to partners, manufacturers, clients, etc.) also check if SWIFT codes are relevant.

There are two ways to find out the correct bank identifier coding information. Remember them both to send money to the Philippines safe and hassle-free:

- The easiest way to get proper SWIFT BIC for the money transfer to the recipient from the Philippine Islands is to contact the representative office of the banking institution you will use for the transaction. Then, operators ask you about your account number and help you pick sides with the required BPI SWIFT code in the Philippines according to the recipient’s personal data.

- The second way is to understand the way these identifier coding figures originate. SWIFT code BPI in the Philippines is BOPIPHMM where all the characters have their sense (BOPI letters are for Bank of the Philippine Islands; PH letters are for the country code; MM letters are for Metro Manila, the location code).

Note that the BPI account is formatted without the need to change it. When it comes to BIC codes for the SWIFT network, they depend on the branches of the Philippine banks required. In most cases, the last four letters presented in the bank identifier coding mentioned above will not change (PHMM). But the banking representative office is not located in the Metro Manila region, the characters after PH (unchanged ones) can differ.

For example, the BIC SWIFT code used for CITIBANK SAVINGS (INC.) transactions will be CITIPH2X. In comparison, most other bank identifier coding characters will differ only with their bank data entries presented in the form of letters and digits at the beginning. Take a closer look at some examples like a Philippine national bank BIC code and some others:

|

Banks |

BIC code |

| Philippine National Bank |

PNBMPHMM |

| Philippine Veterans Bank |

PHVBPHMM |

| PHILTRUST Bank |

PHTBPHMM |

| Union Banks of the Philippines |

UBPHPHMM |

To sum up, it is critically important to be sure that your codes used for SWIFT-based money transfers are correct. Do not confuse them and check the identification letters of the bunking establishment of your interest. The bank location also cannot be somewhere in Metro Manila. Be attentive to details. If any questions related to the BPI SWIFT code for the Philippines or BICs arise, it is better to contact local operators or the customer service of the trusted global financial network.

Additional Information Might Be Asked for Money Transfers

Note that the sender might be asked for more details besides the BPI SWIFT code and BICs. Be ready to provide your personal information to the financial institution that processes your remitting request. Your account details and bank name should be specified in the online form or in written format if you have come to the local office.

Optional information that could be asked together with the BPI account and other must data entries as well:

- Beneficiary ID;

- Intermediary bank name (coding);

- BIC for money transfer to the Philippines.

Why Do People Use SWIFT for Financial Operations?

It is quite easy to send money to the Philippines with the help of this network. First, this is about users’ convenience. Both senders and recipients are in favorable conditions. Only one who undertakes the procedure of sending money to the Philippines requires to pay minimum transfer charges. But these fees are very affordable if compared with traditional banking institutions, finance orders, cheques, etc.

At the same time, some P2P apps and e-platforms state that SWIFT-based payments are not cost-effective. Consumers should explore all the variants before the remittance to ensure they select the best-matching variant for a money transfer to the Philippines.

Main Categories of the SWIFT Users

Together with average consumers who require safe sending money to the Philippines, there are active SWIFT users who know all the codes by heart. They are brokers, traders, depositories, entrepreneurs, retailers, etc. This network is viral among users of any social status and wealth portfolio with different goals, potentials, and requirements.

Key Benefits of Using SWIFT to Send Money to the Philippines

First of all, this is a global network with awesome outreach and coverage. That is why millions of users worldwide entrust their financial operations to this service provider. Safety, flexibility, and fast speed of transactions – this is not the whole list of advantages this digital-friendly system promotes.

All the remittances worldwide including ones with the BPI SWIFT code used in the Philippines for exceptional security and direct transfers with no risk to confuse the recipient are notable with 100% transparency and promptness when it comes to the transaction speed.

Check other strengths this network can bring for you and your finance-related experience:

- Transparent financial operations between employers and employees, businessmen and their partners, investors, and entrepreneurs;

- The well-thought policies of bank identification coding including the presence of the SWIFT code BPI in the Philippines and BICs for safe transfers;

- The modern payment system is constantly updated through different digital-friendly and innovation-driven approaches;

- The high-level accessibility is reached. For example, using BPI and bank identification patterns like the Philippine National Bank BIC code is a progressive step ahead without communication challenges and interaction barriers;

- The exceptional accountability and popularity of the reputable network. With the numerous partnering financial service vendors and the client base that entrusts all the fund transfers to SWIFT, it is possible to enlarge and improve the quality of financial options and the accuracy of the existing packages for users.

Some customers are expecting faster remitting terms soon. The SWIFT team is working in this direction to meet all the client’s expectations in the context of fees, transfer speed, and other aspects.

Summarizing

Now, you know where to search for BPI/BIC codes. Explore them for different destinations. All the codes are based on the characters that symbolize the bank location, regions, the country of the recipient, etc. Check the BPI SWIFT code for the Philippines in our guide and keep track of all the necessary BICs for your ongoing financial operations. It is quite easy to understand all the peculiarities if you know the origin of the letters and digits presented in the coding system there.