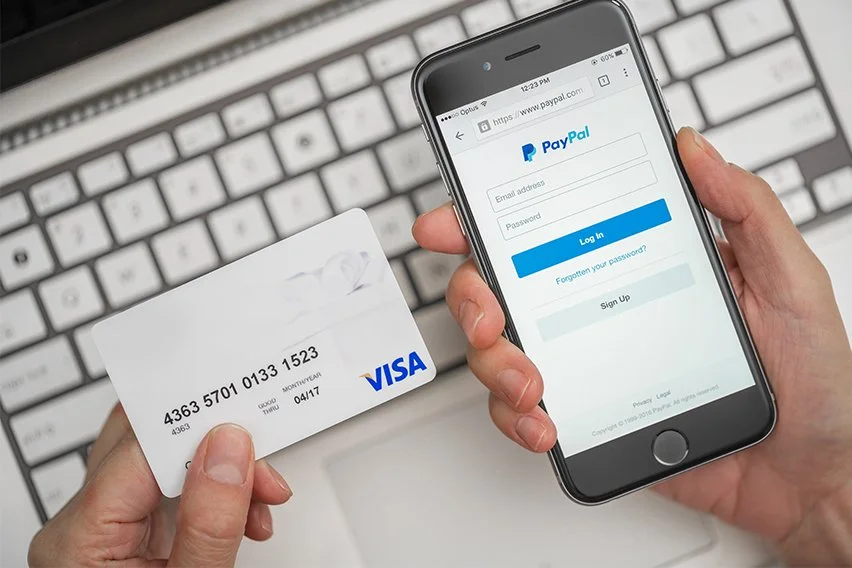

The ability to instantly send and receive money has never been more important. Whether you’re a freelancer looking to get paid by your clients or just want to split bills with your friends, having a PayPal account that can receive funds is a basic skill in this digital era. In this article, we will take you through every step of the process of how to set up a PayPal account so you know how to make the most out of PayPal’s platform.

Unlocking the Power of PayPal: A Comprehensive Overview

Before we proceed to how to set up a PayPal account, let’s learn a bit more about it. PayPal has been hailed as one of the leading lights in electronic financial services globally because of its seamless online transaction platform. At its core, PayPal is a secure online payment system that enables users to make instant transactions with trusted ease.

Benefits of Using PayPal As A Payment System

| Flexibility in transactions | From splitting household expenses with friends to conducting business deals: PayPal has various options for making transfers. |

| Streamlined payments | In order for one to facilitate easy and rapid money transfer; they should link their credit card or bank account with PayPal details. |

| Merchant services | For entrepreneurs and businesses, PayPal offers integrated systems that help streamline their payment processes including customizing buttons for payments and invoicing capabilities. |

| Available on mobile devices | Ideal for busy individuals and professionals who need to access their money while on the move; PayPal has a mobile app. |

Security Measures

Plenty of people want to set up a new PayPal account, and perhaps one of the reasons is its reliable security measures.

- Buyer and seller protection: With a robust buyer and seller protection policy, PayPal ensures that buyers or sales are made with confidence.

- Encryption technology: PayPal uses advanced encryption technology to ensure that unauthorized third parties cannot access your financial information whatsoever.

- Two-factor authentication: By enabling users to use two-factor authentication, it enhances their account’s security hence making it difficult for fraudsters to penetrate through your defenses especially when using your password alone.

Basically, PayPal goes beyond just being a means of collecting money. It is an answer to all modern financial challenges. For instance; sending money to loved ones, shopping online or running successful companies can be done in one go using PayPal, as it provides people with instruments and protection facilitating them in dealing with the intricacies of contemporary financing. So, you can go for it and set up a new PayPal account right now.

How to Set Up a PayPal Account to Receive Money

As you can see, making PayPal work for you is as easy as pie. So, create your personal account now. You can use any of the transactions in the future, or you can go ahead and say thank you to a friend who sent you money electronically. Here’s what you need to know if you wish to learn how to receive payment through PayPal.

Starting Your Journey with PayPal

If you wonder how to receive payment through PayPal, you should know that it is really easy: you simply need to register for that! So, let’s proceed to how to set up a new PayPal account. To set up a new PayPal account, go to PayPal’s website or open the application on your device and begin filling out the registration form. In case someone sends you some money through PayPal, a link will be available in your inbox that will help guide you through the process.

Online Account Setup with PayPal

- Visit the desktop version of PayPal or click on the link provided within an email notifying you about imminent payment via PayPal.

- You would be required to press “Sign up for a PayPal account.”

- Choose the option “Personal” when given and then press “Get Started”. If you need to set up a PayPal business account, choose the corresponding option (it is equally easy to set up a PayPal business account).

- Fill out your personal details, generate a safe password, and just do it!

Adding Vital Details: Navigating Digital Terrain

- Now that your journey with PayPal has begun, start adding important information about yourself, such as your phone number.

- Post-login, set page access and choose the ‘Phone Numbers’ tab from other sections.

- Type in an additional number, then choose its kind, followed by the phone validation process, which guarantees only one person controls your PayPal domain.

Validating Your Email: Asserting Digital Sovereignty

- In addition to being secure passwords for digital worlds, email addresses also have additional layers of security known as confirmation.

- Check your email inbox; expect a letter from PayPal soon enough. As soon as received, confirm it immediately by clicking on an activation link inside.

- Proceed at once with submitting your password into this page till it confirms having a successful key holder standing before them like knights bearing their swords.

So, the question of how to receive money on PayPal is now actually answered. You simply need to set up a PayPal account and confirm a PayPal link to receive money.

Alternatives

Today, many people and businesses are using PayPal to send and receive money online. In fact, it has become common for people to create a PayPal account as it is a convenient and secure way of sending/receiving funds over the Internet.

Nonetheless, there are other digital payment solutions on the market besides PayPal. Many alternatives exist depending on what one requires in such matters. This guide acquaints you with some top-notch variations of PayPal and how they compare when setting up an account for receiving payments.

Stripe

Setting up an account: The procedure for creating a Stripe account is straightforward, similar to that of PayPal. To open a new account, any user can sign up on the Stripe website or use its mobile application. To complete the registration process, one needs to provide their names or business details and link bank accounts where money will be transferred.

Receiving payments: After that has been set up, you may start getting paid by clients or customers in your Stripe account.

For instance, when running online businesses, which consist of a lot of subscription management systems as well as customizable payment forms that include integration options with platforms like Stripe, offer various web services, users have the ability to generate links for payments fast transactions by simply entering them into message dialogues with their clients.

Square

Setting up an account: Another well-known payment processing platform is Square, which comes with a user-friendly interface for setting up accounts. It is possible to create another Square account online or download the Square Point of Sale app on your phone. The registration process involves supplying basic information and confirming your identity.

Receiving payments: Regarding payments, Square enables users to accept payments both physically and online through numerous devices such as smartphones, tablets, and computers. They also offer invoice generation, a virtual terminal for phone orders, and e-commerce integrations for online stores. Customers can also ask for payments via email or text message.

Venmo

Setting up an account: Venmo is a person-to-person payment service owned by PayPal that emphasizes simplicity as well as social interaction. To open a Venmo account you need to download the app on your mobile device and link it to your bank account or debit card. Alternatively, you can sign up through Venmo’s website.

Receiving payments: However, there are several features that differentiate it from PayPal, such as its usage in personal transactions with friends and family members alone. With Venmo’s social feed feature users can easily send and receive money while at the same time they can see and interact with their friends’ payment activities Whereby PayPal offers more comprehensive features for businesses than venmo.

Google Pay

Setting up an account: Google Pay is a digital wallet platform where users can make payments and store their payment details securely. This kind of account setup needs one simply downloading the app onto their mobile device then adding credit/debit cards.

Receiving payments: Google Pay only gives clients access to their funds through Internet banking platforms; this means that once you have received monies (senders), they will be transferred into your nominated bank accounts without having any physical cash coming out from them thereafter, unlike PayPal whereby when someone sends $10 let us say it just remains in the account as $10 which if you wish you can either use it to pay for goods or services online or withdraw it as cash from an atm.

However, when compared with PayPal, Google Pay is more limited in terms of business features.

As you can see, there are a number of alternatives to PayPal that offer similar functionality and convenience, even though PayPal is still widely used for online payments. If you are a small business operator looking out for a payment solution or an individual who wants to send money directly to their friends via a peer-to-peer network then there is certainly an alternative available other than PayPal.

To determine the right payment solutions for your various needs, consider ease of setup and functionalities provided by these alternatives.

Wrapping Up

Within moments, you have successfully made your way through the riddlesome corridors of PayPal’s cyber domain, and now you stand tall as payments from across continents stream into your waiting hands. With your personal PayPal account, all set up, online transactions await you with promises of expediency and economic enfranchisement.